The unfair tax on the cigarette industry by the federal government will incline users towards illegal cigarettes.

The recent increase in federal excise duty on cigarettes in the federal budget and the proliferation of illegal cigarettes in the country have raised new questions.

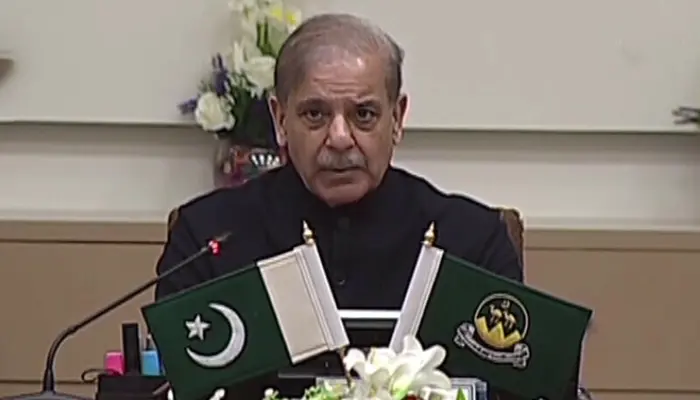

The federal government is relying heavily on cigarettes to generate 170 billion rupees in revenue to meet the budget deficit, which is the highest for any new product.

According to the cigarette industry, Pakistan is the sector with the highest rate of tax theft, and now with the extraordinary increase in federal excise duty, this trend will increase further.

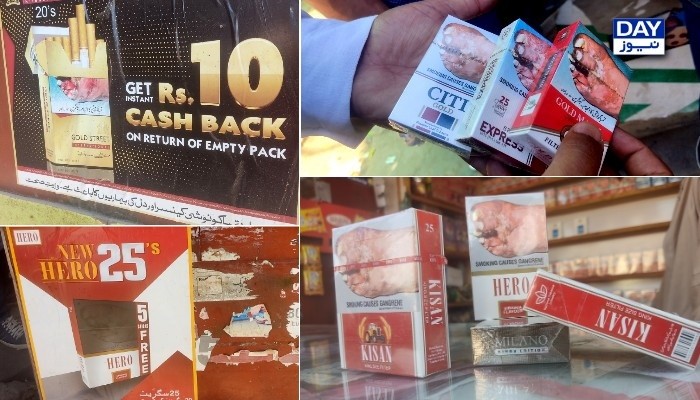

To assess the effects on the market of cigarette tax theft and the recent increase in FED, a delegation of Karachi journalists visited Hyderabad, Jamshoro and Kotri.

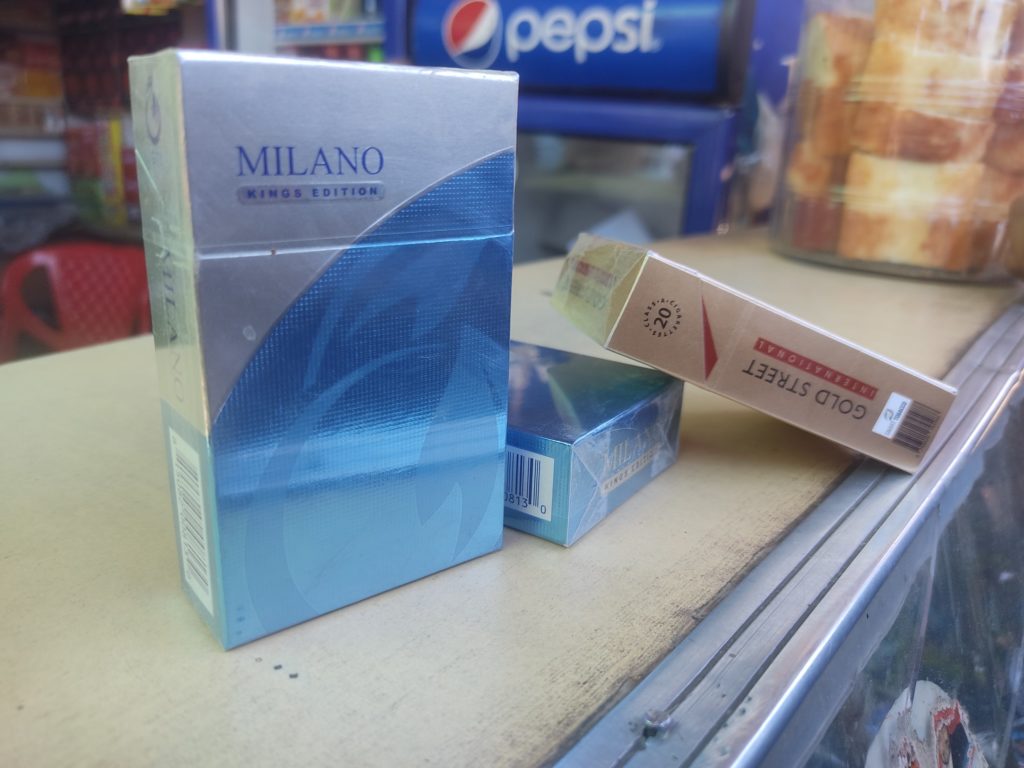

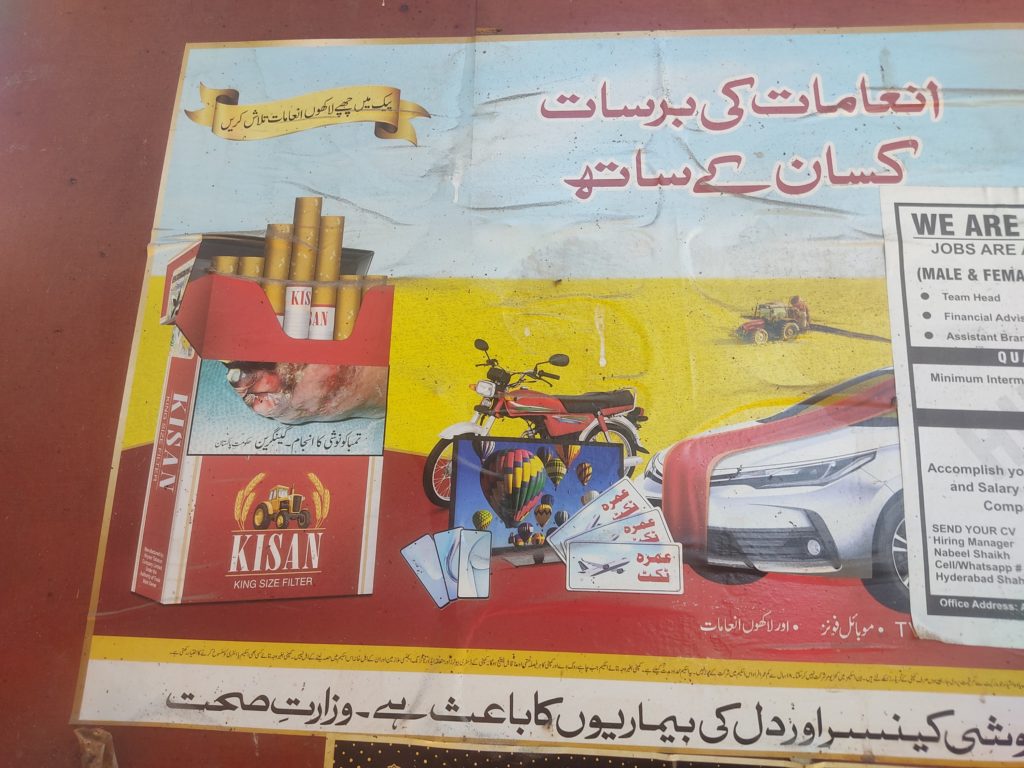

During this visit, prices, packaging and incentives for brands sold in large stores with small cabins were evaluated.

In this research tour, different brands were sold at half the government’s prescribed price, and various types of incentive schemes and posters were hung to increase sales.

Despite strong opposition from the legal industry that makes and sells cigarettes, an extraordinary increase in federal excise duty has been imposed, resulting in a sudden 100% increase in the price of legal cigarettes.

Surprisingly, at a cigarette store in Lahore, smuggled brands of cigarettes are sold at a lower price of 50 to 100 rupees per packet compared to locally manufactured illegal cigarettes.