Pakistan’s weekly inflation, measured by the Sensitive Price Indicator (SPI), has jumped to 41.54% on a year-on-year basis for the week ended on Feb 23.

This is the first time inflation has crossed the 40% mark in over five months. The previous week saw an increase of 2.89% to reach 38.42%.

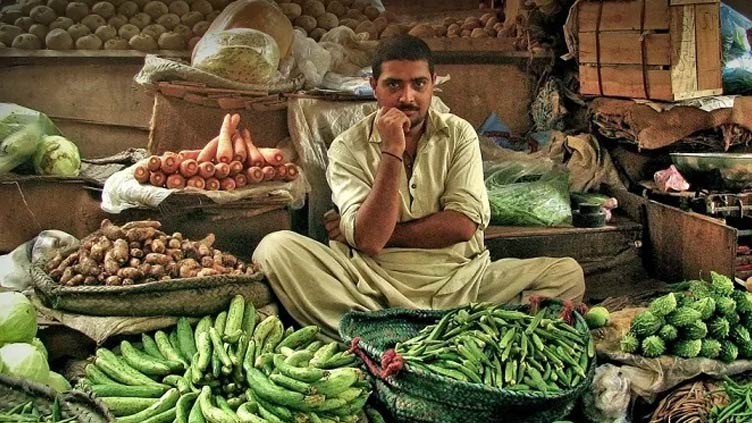

The increase was mainly due to the rise in food prices, such as bananas, chicken, sugar, cooking oil, vegetable ghee, and tea prepared. Non-food items such as gas and cigarettes also saw an increase in prices.

In contrast, some food items such as onions, eggs, tomatoes, garlic, LPG, and pulse gram (0.21) saw a slight decrease in prices.

According to the Pakistan Bureau of Statistics (PBS) report, out of 51 items, prices of 33 (64.71%) items increased, 06 (11.76%) items decreased, and 12 (23.53%) items remained stable during the week.

The increase in inflation comes as Pakistan takes measures to meet the conditions of the International Monetary Fund (IMF) for the revival of the loan programme.

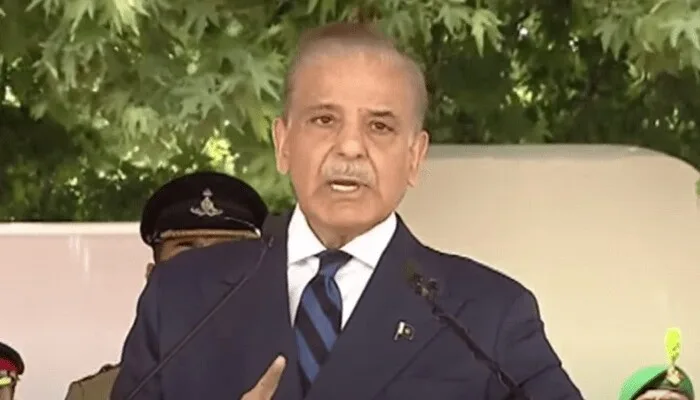

Earlier this week, Prime Minister Shehbaz Sharif warned that inflation would further increase after the approval of the IMF programme.

To boost revenue generation in line with the preconditions of the IMF, the federal government has also approved a ‘mini-budget’ to impose additional taxes of Rs170 billion.

Pakistan’s economy has been struggling in recent years, with the country seeking help from the IMF. In 2019, Pakistan reached an agreement with the IMF for a $6 billion loan programme to address its balance of payments crisis.

The IMF programme aimed to strengthen Pakistan’s economy by implementing reforms such as improving tax collection, increasing energy tariffs, and controlling government spending.

The COVID-19 pandemic has further worsened Pakistan’s economic situation, with the country experiencing a negative growth rate of 0.4% in 2020.

The government has taken several measures to mitigate the pandemic’s impact on the economy, including a relief package worth Rs1.2 trillion.

Despite the government’s efforts, Pakistan’s economy remains vulnerable due to various factors such as political instability, security challenges, and a lack of foreign investment.

The country’s economy heavily relies on remittances from overseas Pakistanis, which account for around 8% of the country’s GDP.

Inflation has been a persistent problem for Pakistan’s economy, with the country’s consumer price inflation rate averaging 7.86% from 1957 until 2021.

High inflation rates reduce people’s purchasing power, leading to a decline in economic growth. The rising inflation rate in Pakistan is likely to have a negative impact on the country’s economy, especially for low-income households.

To combat inflation, the State Bank of Pakistan has increased its policy rate, which is the rate at which banks borrow money from the central bank.

The policy rate has been increased by a cumulative 625 basis points since January 2018, reaching 13.25% in July 2019.

The State Bank of Pakistan has also taken measures such as tightening monetary policy, improving tax collection, and increasing the production of essential goods to control inflation.

In conclusion, Pakistan’s weekly inflation has jumped to 41.54% for the first time in five months, mainly due to the rise in food prices and non-food items.

The country’s economy remains vulnerable due to various factors, and the rising inflation rate is likely to have a negative impact, especially on low-income households.

The government and central bank have taken measures to combat inflation, but it remains a persistent problem that needs to be addressed.