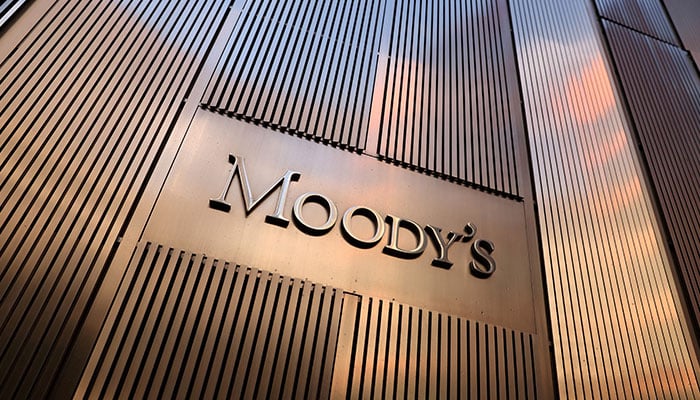

Moody’s Ratings has upgraded Pakistan’s local and foreign currency issuer and senior unsecured debt ratings to Caa2 from Caa3. The improvement in macroeconomic conditions prompted the upgrade, Moody’s said on Tuesday.

Moody’s also upgraded the rating for Pakistan’s senior unsecured MTN programme to (P)Caa2 from (P)Caa3. The outlook for the Government of Pakistan has shifted from stable to positive.

This upgrade reflects Pakistan’s better macroeconomic conditions and slightly improved government liquidity and external positions, though they remain weak. Pakistan’s default risk has decreased to a level consistent with a Caa2 rating, according to Moody’s. The staff-level agreement with the IMF on a $7 billion Extended Fund Facility (EFF) on July 12, 2024, has created more certainty regarding external financing.

Moody’s expects the IMF Executive Board to approve the Pakistan loan deal in the coming weeks. Pakistan’s foreign exchange reserves have nearly doubled since June 2023, though they still fall short of what is needed to meet external financing requirements.

Despite these improvements, Moody’s warned that Pakistan’s debt affordability remains very weak, leading to high debt sustainability risks. Interest payments are expected to absorb about half of government revenue over the next two to three years. The rating also factors in weak governance and high political uncertainty.

The positive outlook reflects a balance of risks, with the possibility that the government could further reduce liquidity and external vulnerability risks and achieve a stronger fiscal position, supported by the IMF programme.

Sources indicate that Pakistan is not on the IMF’s Executive Board meeting agenda until September 4, 2024. However, the government remains hopeful of securing approval for the $7 billion IMF bailout package next month.

Moody’s stressed that sustained reforms, particularly in revenue-raising, could enhance the government’s revenue base and improve debt affordability. Completing IMF reviews promptly would help Pakistan secure sufficient financing from official partners, meet external debt obligations, and rebuild foreign exchange reserves.

The upgrade to Caa2 from Caa3 also applies to the backed foreign currency senior unsecured ratings for The Pakistan Global Sukuk Programme Co Ltd, which Moody’s views as direct obligations of the Government of Pakistan. The outlook for this programme is also positive.

Moody’s has raised Pakistan’s local and foreign currency country ceilings to B3 and Caa2 from Caa1 and Caa3, respectively. The two-notch gap between the local currency ceiling and sovereign rating is due to the government’s large role in the economy, weak institutions, and high political and external vulnerability risks. The gap between the foreign currency ceiling and the local currency ceiling reflects incomplete capital account convertibility and weak policy effectiveness.

Read More: Nationwide Strike Disrupts Businesses as Traders Protest Tax Reforms

Follow us on Instagram, YouTube, Facebook, Whats App, and TikTok for latest updates.