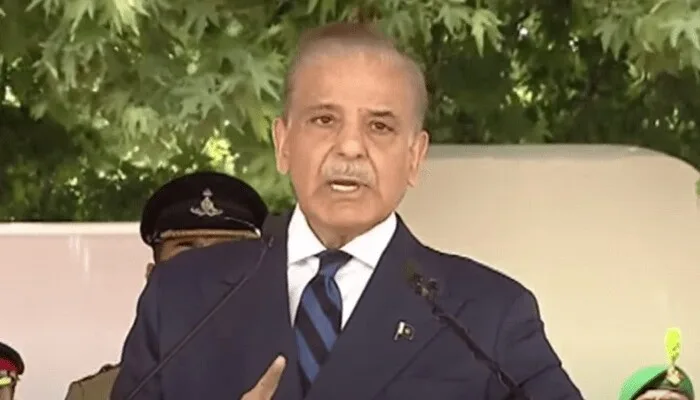

Prime Minister Shehbaz Sharif announced that his government is committed to implementing the International Monetary Fund’s (IMF) conditions to complete the $7 billion loan program. He expressed hope that this will be the country’s last borrowing from the IMF.

In July, Pakistan and the IMF agreed on a 37-month loan program. However, the program requires approval from the IMF’s executive board. It also needs “timely confirmation of necessary financing assurances” from Pakistan’s development and bilateral partners.

PM Shehbaz, speaking to Reuters on Tuesday, said, “Once the IMF board approves the program, we will enter a new phase.” He added that the government is diligently working on fulfilling all the IMF’s conditions.

In August, Moody’s reported that Pakistan’s default risk had reduced to a level consistent with a Caa2 rating. This improvement came after Pakistan’s staff-level agreement with the IMF on July 12, 2024, for the $7 billion Extended Fund Facility (EFF). Moody’s noted that there is now greater certainty regarding Pakistan’s external financing sources.

However, concerns have arisen as Pakistan’s loan approval is not on the agenda of the IMF Executive Board’s latest meeting schedule. This loan deal is crucial for stabilizing the country’s struggling economy.

Despite this, the government remains optimistic. Officials believe that Pakistan will secure the $7 billion bailout package approval from the IMF next month.

Finance Minister Muhammad Aurangzeb addressed the nation today in a televised message. He confirmed that Pakistan had already signed a Staff Level Agreement (SLA) with the IMF. He mentioned that the country is in the advanced stages of securing the agreement’s approval by the IMF executive board.

Aurangzeb echoed the Prime Minister’s hope that this will be Pakistan’s last IMF program. However, he stressed that achieving this goal will require structural reforms and self-sufficiency.

The Finance Minister reaffirmed the government’s commitment to carrying out its reform agenda. This includes broadening the tax base and rightsizing the federal government to achieve macroeconomic stability. He referred to these measures as “basic hygiene” necessary for sustainable growth.

Aurangzeb also announced plans to impose new taxes on the retail sector, despite facing public backlash and strike threats. These taxes are part of the government’s efforts to meet ambitious revenue targets, crucial for securing the IMF deal.

He made it clear in his speech that the government will not back down from these taxes. He urged wholesalers, distributors, and retailers to contribute to the economy by accepting the new tax scheme.

The announcement followed a nationwide strike by retailers protesting against the new tax scheme and high electricity rates. The strikes are part of ongoing protests against rising tariffs, taxes, and inflation.

Muhammad Sharjeel Goplani, chairman of the All-City Tajir Ittehad Association, had threatened an indefinite strike if the demands were not met. However, no further action has been announced.

The IMF’s board approval depends on confirmation of financing assurances from Pakistan’s development and bilateral partners. Local media reported that the approval was delayed due to a lack of additional financing and unpaid energy sector subsidies.

Punjab’s Information Minister, Azma Bukhari, stated that the federal government and the IMF had not contacted the province about an electricity subsidy. She also mentioned that the IMF had not released any written statement.

The IMF, the finance ministry, and the power ministry did not immediately respond to requests for comments. Reining in unresolved debt in Pakistan’s power sector remains a top concern for the IMF, especially after the end of a $3-billion bailout in April that led to higher tariffs and cut household use for the first time in 16 years.

Follow us on Instagram, YouTube, Facebook, Whats App, and TikTok for latest updates.