Israel’s recent threat to target Iran’s oil production infrastructure has sparked major concerns about the international crude oil supply. This threat includes attacks on gas and oil rigs, refineries, and storage facilities. As a result, market anxiety has surged, leading to a significant spike in global crude prices during the U.S. trading session.

On Tuesday, the price of both U.S. light crude oil and Brent crude oil futures rose by more than 2 percent. This upward trend continued into Wednesday, signaling growing market concerns. Specifically, the price of light crude oil futures for November delivery on the New York Mercantile Exchange reached $72.13 per barrel in Wednesday morning trading. Meanwhile, London Brent crude oil futures for December delivery climbed to $75.74 per barrel.

During the U.S. trading session on Tuesday, international oil prices experienced a dramatic surge. Prices rose by over 5 percent, reaching an intraday high. However, this rally was not sustained, as market sentiment gradually stabilized, leading to a slight retreat in prices.

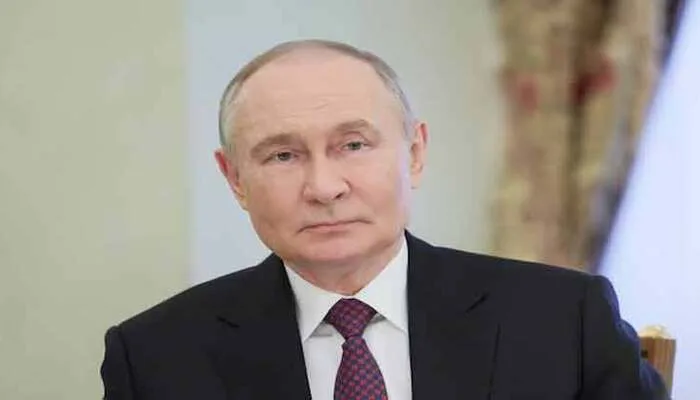

Masoud Pezeshkian Warns Israel to Avoid Entering into Conflict with Iran

Analysts believe that the fluctuations in oil prices are closely tied to geopolitical tensions. The threat from Israel adds a layer of uncertainty to an already volatile market. As investors weigh the implications of potential military actions, they remain cautious. The threat to Iran’s oil infrastructure raises alarms about the stability of the region and the global oil supply chain.

Moreover, Iran is one of the key players in the global oil market. Any disruption in its production could have ripple effects worldwide. Market observers note that even rumors of conflict can lead to price volatility. Thus, the situation warrants close monitoring.

Furthermore, this increase in oil prices impacts not only traders but also consumers. Higher crude oil prices often translate to increased fuel costs for consumers. This, in turn, can lead to higher prices for goods and services, as transportation costs rise.

In response to the situation, some analysts suggest that the market could stabilize if tensions ease. However, if military actions occur, the potential for further price increases remains high. The overall sentiment in the market is cautious, with many investors keeping a close eye on developments.

Biden Opposes Strikes on Iran’s Nuclear Sites

In addition to the price changes, analysts are also assessing the broader implications of this situation. The potential for conflict between Israel and Iran could shift the dynamics in the Middle East. This might affect other oil-producing countries and their production strategies as well.

Overall, Israel’s threats have created a tense atmosphere in the oil market. As prices continue to fluctuate, traders and consumers alike are left wondering what the future holds. The international community watches closely, hoping for a resolution to prevent further escalation.

The threats against Iran’s oil infrastructure have significantly impacted international oil prices. With prices rising sharply, market participants are on high alert. The geopolitical landscape is fluid, and the potential for conflict remains a pressing concern for all involved.

Follow us on Google News, Instagram, YouTube, Facebook,Whats App, and TikTok for latest updates