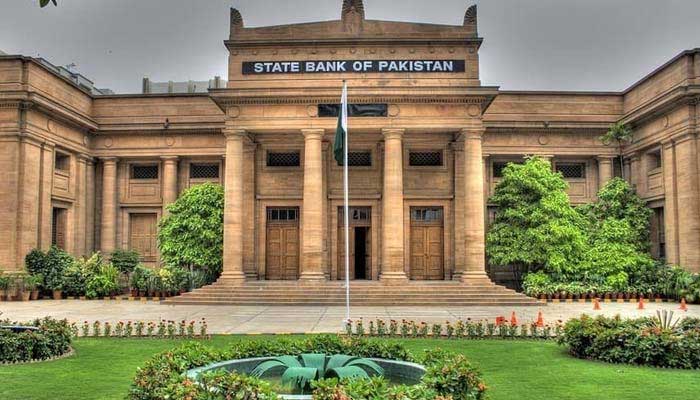

Raast, Pakistan’s instant payment system, has processed 892 million transactions, with a total value of PKR 20 trillion. The system, developed by the State Bank of Pakistan (SBP), continues to break records. Notably, the most recent trillion was processed in just 16 days.

This rapid growth highlights SBP’s dedication to revolutionizing digital payments in Pakistan. Raast is designed to make financial transactions faster, safer, and more accessible for everyone. It aims to empower individuals and businesses by offering a seamless way to transfer funds, pay bills, and make purchases.

Cashless Society

The system’s success reflects SBP’s vision of a cashless society and a shift toward a digital economy. Raast allows users to send money instantly, without the need for traditional banking processes. This innovation is reducing reliance on cash and promoting financial inclusion, especially for the unbanked population.

Read: Israel’s President Praises Forces for Killing Hamas Leader Yahya Sinwar

The accelerated pace of transactions also demonstrates growing public trust in digital platforms. More people and businesses are using Raast for their financial needs. This development is crucial for Pakistan’s economic future, as it supports transparency, reduces transaction costs, and encourages efficient financial services.

SBP continues to invest in enhancing the digital infrastructure. The success of Raast showcases its commitment to making financial services accessible to all Pakistanis. The country’s digital payment landscape is evolving rapidly, and Raast is playing a key role in this transformation.

Follow us on Google News, Instagram, YouTube, Facebook,Whats App, and TikTok for latest updates