For the second day in a row, gold prices have declined in both international and local markets. In the global bullion market, the price per ounce dropped by $8, settling at $2,726. This downward trend reflects ongoing fluctuations in the precious metals market amid broader economic shifts.

In local markets, the price of 24-karat gold have also declined. The rate decreased by Rs800 per tola, bringing it to Rs282,300. Similarly, the price for 10 grams of gold dropped by Rs686, now at Rs24,2027. This consecutive decline in gold prices has impacted local jewelers and investors, who are closely monitoring the market for signs of stability.

Silver Prices Remain Steady

Despite the fall in gold prices, silver rates stayed consistent. The price per tola of silver held at Rs3,350, while the rate for 10 grams remained unchanged at Rs2,872.08. The stability in silver prices contrasts with the volatility seen in gold, providing a steady option for investors in the precious metals market.

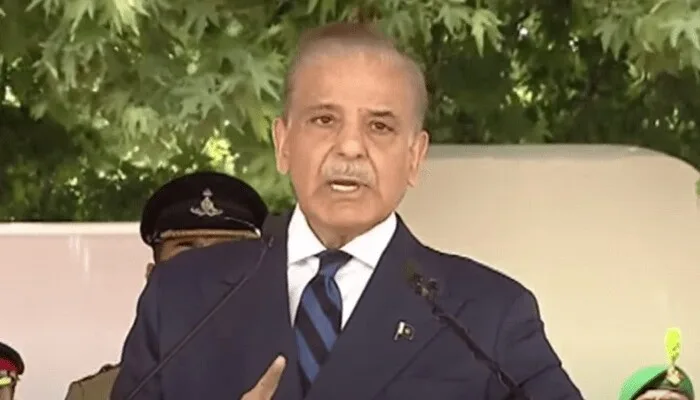

Pakistan Stock Exchange Reaches New Milestone

Meanwhile, the Pakistan Stock Exchange (PSX) achieved a historic milestone on Friday. The KSE-100 index surged past the 90,000-point threshold during intra-day trading. By 10 a.m., the index had reached 90,087.41 points, marking a gain of 1,109.73 points, or a 1.25% increase from the previous close of 88,945.98.

This rise in the KSE-100 index reflects a bullish trend that has dominated the market throughout the week. On Thursday, the index had already crossed the 89,000 mark, showcasing strong investor confidence. Market optimism is high, largely driven by positive economic reforms and recent government initiatives aimed at boosting the economy.

High Trading Volume Signals Investor Confidence

Investor participation in the PSX also showed robust growth. A total of 62,341,937 shares were traded, reflecting the strong market activity and enthusiasm among investors. The value of shares traded reached Rs5,057,954,342, highlighting a significant flow of capital into the market.

Analysts suggest that the surge in trading volume and market value is a direct response to favorable government policies and reforms. This uptick in stock market performance contrasts with the declining trend in gold prices, indicating a shift in investor focus towards equities.

Market Trends to Watch

The decline in gold prices and the rise in the KSE-100 index are indicators of shifting market trends. While gold traditionally serves as a safe-haven asset, recent drops suggest changes in investor sentiment, possibly influenced by global economic factors and shifting demand.

The stability in silver prices, combined with the PSX’s record-breaking performance, highlights a unique moment in Pakistan’s financial landscape. Investors and analysts will continue watching these trends closely as they assess the longer-term impact on both the precious metals market and the stock exchange.

Follow us on Google News, Instagram, YouTube, Facebook,Whats App, and TikTok for latest updates