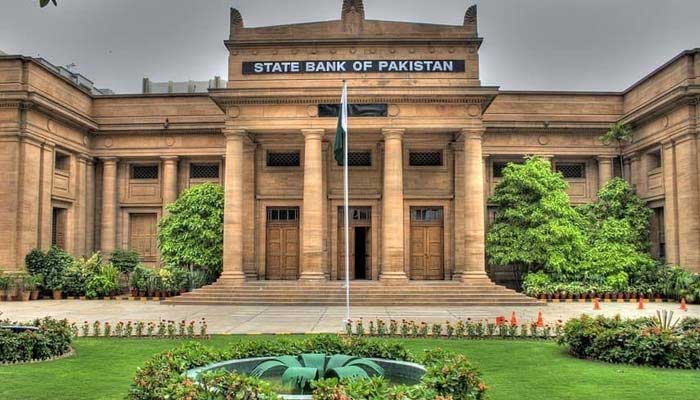

The Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) met today to announce a significant policy change. The MPC decided to cut the policy rate by 250 basis points, lowering it to 15 percent. This reduction will take effect from November 5, 2024.

Inflation Trends

The MPC observed a notable decline in inflation, which has fallen faster than expected. By October, inflation neared its medium-term target range. The committee credited a tight monetary policy for this positive trend. Contributing factors included a sharp decrease in food inflation and favorable global oil prices. Additionally, the absence of anticipated increases in gas tariffs and petroleum development levy (PDL) rates aided disinflation. However, the MPC cautioned that inflation might remain volatile in the short term due to inherent risks.

Key Economic Developments

Several crucial developments have occurred since the last meeting. The International Monetary Fund (IMF) Board approved Pakistan’s new Extended Fund Facility (EFF) program. This approval has reduced uncertainty and improved the outlook for external inflows. Recent surveys indicate improved consumer and business confidence, with lowered inflation expectations. Moreover, secondary market yields on government securities and the Karachi Interbank Offered Rate (KIBOR) have decreased significantly. However, tax collection during the first four months of FY25 fell short of targets, posing a challenge.

Macroeconomic Stability

The MPC believes the current monetary policy stance is appropriate for achieving lasting price stability. Maintaining inflation within the 5-7 percent target range supports macroeconomic stability and fosters sustainable economic growth. The committee aims to balance inflation control with economic development.

Real Sector Performance

Data indicates a gradual recovery in economic activity. Initial estimates for major Kharif crops surpassed expectations. Increased rice and sugarcane production helped offset shortfalls in maize and cotton. The industrial sector is gaining momentum, particularly in textiles, food, and automobiles. Rising imports of raw materials and machinery, combined with improving business confidence, support this positive trend. The MPC now forecasts real GDP growth for FY25 to range between 2.5 and 3.5 percent.

External Sector Developments

In September 2024, the current account recorded a surplus for the second consecutive month, narrowing the cumulative deficit to $98 million in Q1-FY25. Strong remittances and higher exports have managed the deficit, despite increased imports. Foreign investment also experienced a slight uptick in September. Following the first tranche under the IMF program, SBP’s foreign exchange reserves increased to $11.2 billion as of October 25, 2024. The MPC expects imports to rise further but maintains that robust remittances and exports will help keep the current account deficit within the 0-1 percent of GDP range.

Fiscal Sector Insights

During Q1-FY25, Pakistan achieved fiscal and primary surpluses of 1.4 percent and 2.4 percent of GDP, respectively. This improvement is largely due to record-high profits from the SBP, boosting non-tax revenues. However, the Federal Board of Revenue (FBR) has struggled to meet tax collection targets. The MPC emphasized the importance of ongoing fiscal consolidation and reforms to broaden the tax base and mitigate losses from public sector enterprises.

Money and Credit Dynamics

As of October 25, broad money (M2) growth increased to 15.2 percent year-on-year. Notably, net budgetary borrowing from the banking system decreased, while credit to the non-government sector rose. Following the receipt of SBP profits, the government reduced its borrowing from banks, allowing banks to extend more credit to the private sector. The MPC anticipates increased demand for private sector credit as economic activity continues to pick up.

Inflation Outlook

Since the last MPC meeting, inflation has eased significantly. The headline inflation rate dropped from 9.6 percent in August to 7.2 percent in October. The MPC expects this trend to persist, projecting average inflation for FY25 to be considerably lower than previous forecasts. However, risks remain, including geopolitical tensions and potential adjustments in administered prices.

Follow Day News on Google News, Instagram, YouTube, Facebook, Whats App, and TikTok for latest updates