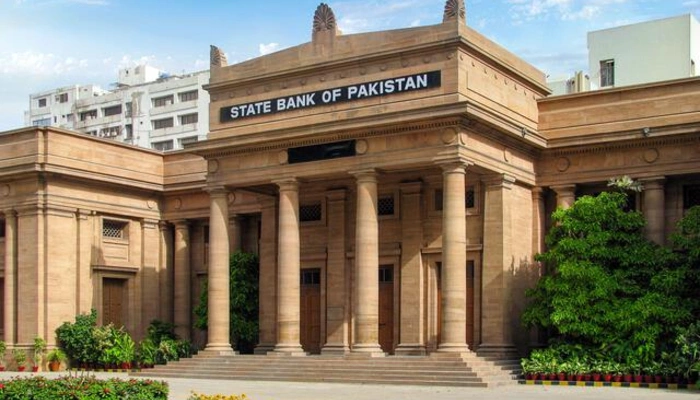

KARACHI: The State Bank of Pakistan (SBP) reported a drop of $228 million in its foreign exchange reserves, which fell to $11.85 billion during the week ending December 20. This marked the first decline after weeks of consistent increases. The SBP attributed the decrease to external debt repayments.

Pakistan faces $26.1 billion in external debt repayments during the current fiscal year. While some payments have been made and a portion of the debt rolled over for another year, approximately $14 billion remains outstanding for FY25. With limited official foreign inflows, the SBP has turned to the banking market to buy dollars to meet these obligations.

Reserve Targets for FY25

The SBP aims to increase its reserves to $13 billion by the end of FY25. The recent increases in reserves during the last two months provided optimism that the target could be reached ahead of schedule.

The SBP’s report also highlighted a reduction in the country’s overall foreign exchange reserves. Total reserves dropped by $261 million, reaching $16.371 billion. Commercial banks also saw a decrease, with their holdings shrinking by $33 million to $4.518 billion.

Economic Challenges Persist

Despite recent gains in foreign reserves, Pakistan’s economic challenges remain significant. The government faces the dual burden of maintaining external payments while managing limited inflows. With $14 billion still to be repaid and fiscal pressures mounting, the country’s economic stability depends on securing additional inflows and meeting reserve targets.

The SBP’s reserve levels and fiscal management strategies will remain critical in the coming months as Pakistan navigates its external debt obligations and broader economic challenges.

Follow Day News on Google News, Instagram, YouTube, Facebook, Whats App, and TikTok for latest updates