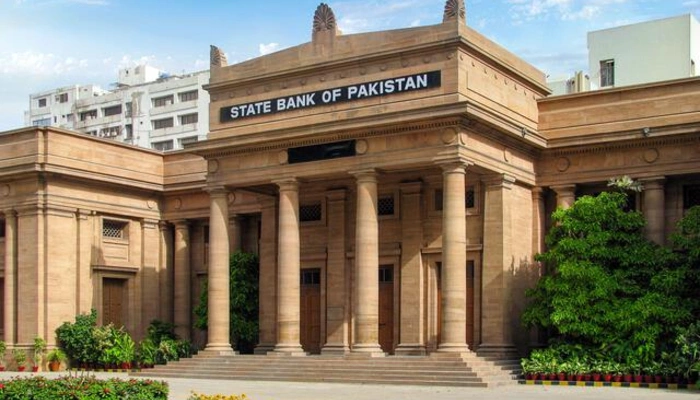

Karachi: Zafar Paracha, Secretary General of the Exchange Companies Association of Pakistan (ECAP), has expressed strong support for the State Bank of Pakistan’s (SBP) newly introduced framework for exchange companies. He praised this initiative as a transformative step toward improving operational efficiency, ensuring customer security, and eliminating illegal trading in the gray market.

Paracha commended the SBP Governor and his team for their relentless dedication to the country’s economic stability. He highlighted the Governor’s prioritization of national interest over personal gains, describing it as an unmatched commitment to Pakistan’s prosperity.

The updated framework is designed to strengthen Pakistan’s financial sector and enhance public trust. Paracha emphasized that the changes introduced by the SBP will play a crucial role in stabilizing the economy and curbing illicit activities in the exchange market. He noted that such initiatives are essential for long-term financial security and economic growth.

Key Achievements Under SBP Leadership

Under the SBP’s current leadership, Pakistan has achieved significant milestones. Paracha highlighted the narrowing gap between the open market and interbank exchange rates, which previously stood at a staggering PKR 15 difference. This reduction has brought much-needed stability to the currency market.

He also noted an increase in remittances, which reflects growing confidence in formal financial channels. Declining inflation rates have provided relief to the public, while lower interest rates and a booming stock market have signaled economic recovery. Improved macroeconomic indicators, such as a reduced current account deficit, have strengthened the country’s foreign reserves.

Averting a Financial Crisis

Paracha lauded SBP’s timely interventions during a period of economic uncertainty. He pointed out that at one point, the USD rate surged to PKR 350 in the gray market, 335 in the open market, and 317 in the interbank market. These alarming rates raised fears of a potential default. However, decisive actions by the SBP successfully restored stability, averting a financial crisis and steering the economy away from disaster.

Promoting Financial Inclusion

The SBP’s efforts to expand financial inclusion have also been commendable. Initiatives such as the Roshan Digital Account and Asaan Mobile Account have enabled millions of people to access banking services. These programs are empowering underserved populations and driving financial inclusion across the country.

Commitment to Collaboration

Paracha reaffirmed ECAP’s commitment to working closely with the SBP to ensure the successful implementation of the new framework. He expressed confidence that this collaboration would lead to significant improvements in the country’s financial ecosystem.

Follow us on Google News, Instagram, YouTube, Facebook,Whats App, and TikTok for latest updates