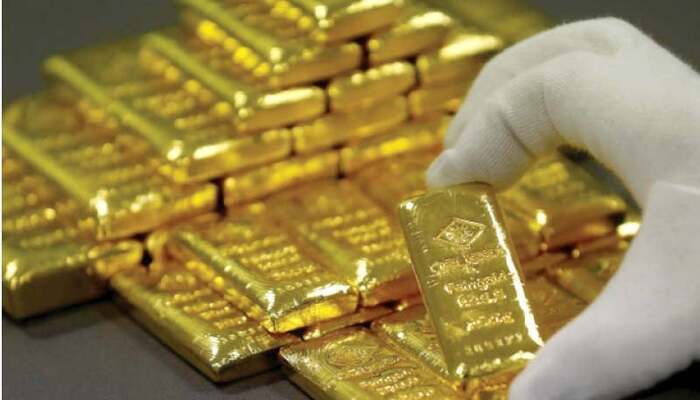

KARACHI: Gold prices in Pakistan continued to decline for the second consecutive day on Tuesday, reflecting a similar trend in global markets. The price per tola fell by Rs1,400, closing at Rs277,900 in the local market. The price of 10 grams of gold also dropped by Rs1,201, ending at Rs238,254, according to the All-Pakistan Gems and Jewellers Sarafa Association (APGJSA).

Local Gold Prices Show Decline

On Monday, gold prices had already seen a decrease of Rs1,500, with the price per tola settling at Rs279,300. On Tuesday, the decline continued, following international market trends. Globally, gold was priced at $2,661 per ounce, with a $20 premium. The drop in gold prices has left market participants uncertain, as they await upcoming economic indicators that could influence the precious metal’s future value.

Global Market Remains Cautious

Adnan Agar, Director of Interactive Commodities, pointed out that there had been little movement in the gold market on Tuesday. He explained that gold fluctuated between $2,660 and $2,675, with the market stabilizing at $2,668. Market watchers are awaiting the US monthly inflation data release, scheduled for Wednesday, which could provide further direction for gold prices.

Read more: Israel and Hamas Near Gaza Ceasefire as Talks Enter Final Stages

Agar also highlighted the potential influence of upcoming political developments, particularly the return of Donald Trump to the political scene on January 20. If Trump reinstates tariffs, similar to those during his previous term, inflation could rise, prompting the US Federal Reserve to hold off on interest rate cuts.

US Dollar and Global Economic Concerns

On the currency front, the Pakistani rupee remained relatively stable against the US dollar. The rupee depreciated by just 0.01% in the interbank market, closing at 278.72 by the end of the trading day. This slight loss of 4 paisa follows a previous decline of the rupee on Monday, which closed at 278.68.

Globally, the US dollar remained near its highest level in over two years, driven by stronger-than-expected economic data. Traders adjusted their expectations for US interest rate cuts in 2025, strengthening the dollar. Meanwhile, concerns over the fiscal stability of the UK kept pressure on the British pound, contributing to a cautious global economic environment.

Follow Day News on Google News, Instagram, YouTube, Facebook, Whats App, and TikTok for latest updates