The Pakistan Stock Exchange (PSX) continued its rally, fueled by surging oil prices, foreign investment pledges, and hopes for further monetary easing. Investor confidence strengthened as the KSE-100 Index climbed 253.96 points, closing at 113,342.43, with the keyword “economic optimism” driving market sentiment.

Key Gains in KSE-100 Index

The KSE-100 Index reached an intraday high of 114,029.75, while the lowest level of the session was recorded at 113,060.25. The strong market performance reflected increased buying activity across multiple sectors, driven by positive economic developments.

World Bank Investment Boost

Investor sentiment received a significant boost after the World Bank pledged $40 billion in investment. Prime Minister Shehbaz Sharif welcomed the funding, calling it a “new chapter” in Pakistan’s development.

The investment includes $20 billion for Pakistan’s private sector through the International Finance Corporation (IFC) and another $20 billion for public sector projects. These funds will support infrastructure, health, education, and youth development initiatives.

Read: India’s Got Latent Row: FIR Against All Involved

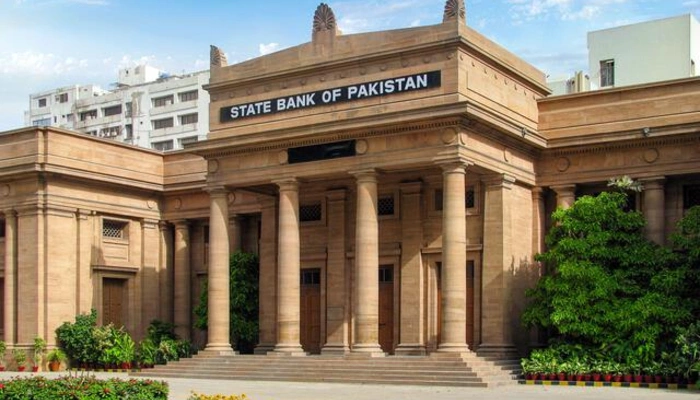

IMF Review and Financial Inflows

Pakistan’s economic team is preparing for the upcoming IMF review, scheduled for March 4, under the $7 billion Extended Fund Facility (EFF). The IMF Executive Board is expected to approve a $1 billion tranche by April 2025.

So far, Pakistan has received $5.5 billion in foreign loans this fiscal year, including IMF disbursements. However, this figure falls short of the projected $19 billion inflow for FY25.

IT Sector’s Strong Performance

Pakistan’s IT sector continued its robust growth, reporting $313 million in exports for January 2025. This figure represents an 18% year-on-year increase, despite a 10% monthly decline compared to December 2024.

Cumulatively, IT exports for the first seven months of FY25 (July to January) surged 27% year-on-year to reach $2.18 billion. This marks the 16th consecutive month of year-on-year growth since October 2023.

Sector-Specific Strengths

“Surging global crude oil prices, robust export data, strong earnings in fertilizer, cement, and banking sectors, and expectations of further monetary easing all played a role in the market’s bullish momentum,” noted Ahsan Mehanti, Managing Director and CEO of Arif Habib Commodities.

The cement sector led the gains, benefiting from falling coal prices and increased infrastructure development projects. The banking sector also saw strong buying ahead of upcoming earnings announcements from commercial banks.

PSX Recovery Momentum

The PSX staged a sharp recovery on Tuesday, snapping a four-session losing streak. The KSE-100 Index surged 1,344.95 points, closing at 113,088.48 after reaching an intraday high of 113,252.55. Investors took advantage of attractive stock valuations and sector-specific gains, further fueling the market’s upward momentum.

Outlook for PSX

With rising foreign investments, strong sector performances, and optimistic monetary policy expectations, PSX remains poised for further growth. Investors are now watching for upcoming economic developments and earnings reports to sustain the bullish sentiment.

Follow us on Google News, Instagram, YouTube, Facebook,Whats App, and TikTok for latest updates