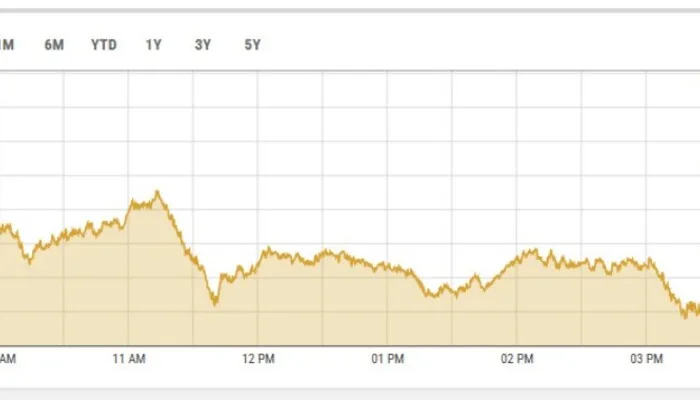

The Pakistan Stock Exchange (PSX) staged a strong recovery on Thursday, rallying over 2,000 points after US President Donald Trump temporarily suspended tariffs on dozens of countries — except China — for 90 days. The move eased investor concerns and brought relief to markets worldwide, including the KSE-100 index, which mirrored the global bounce-back.

Market Opens with Sharp Gains

The KSE-100 index opened on an exceptionally bullish note, surging 3,331 points — a 2.92% increase — reaching 112,891.48 within minutes of trading. The enthusiasm was driven by optimism around the US decision, which many saw as a step back from escalating trade tensions that had rattled markets globally.

However, the market soon faced some volatility. The index dipped later in the day, falling to 116,232.29 and remained below 117,000 for much of the afternoon. Despite this dip, it held on to strong gains and closed at 116,189.21, up 2,036 points or 1.78% from the previous close.

Read: Global Trade War Intensifies as China Strikes Back With 84% Tariffs on US Goods

Tariff Reversal Brings Global Relief

Mohammed Sohail, CEO of Topline Securities, attributed the early morning rally to a global market trend. “PSX followed international cues and opened 3,000 points higher, gaining nearly 2.5%,” he said.

The sudden rollback of tariffs on non-Chinese imports helped ease recession fears. Investors had been bracing for deeper market disruptions after Trump implemented new duties earlier in the week. But the 90-day pause shifted sentiment, especially in economies reliant on global trade.

Oil Prices Offer Additional Boost

Awais Ashraf, Research Director at AKD Securities, noted that the pause in tariffs helped investors refocus on Pakistan’s improving macroeconomic indicators. He emphasized that Pakistan, as an import-heavy economy with significant reliance on oil, stands to benefit from the recent drop in global oil prices.

“A $10 per barrel drop in oil can lower our import bill by $2.1 billion,” he said. “This would provide relief on both inflation and the current account.” He also clarified that while oil prices affect trade balances, they have limited influence on remittances from Gulf countries.

Rebound Reflects Global Sentiment

Samiullah Tariq, head of research at Pak-Kuwait Investment Company, explained that PSX’s gains reflect a broader global recovery. “The market’s positive response is tied to the rebound in international indices after the US softened its tariff stance,” he noted.

The timing of Trump’s move is critical. Just a day earlier, steep tariffs on China came into effect, raising duties on Chinese goods to 125% from the previous 104%. While this signaled continued tensions between the two powers, the simultaneous easing for other nations has softened the overall impact.

A Glimpse of Optimism

Before the tariff pause, investor sentiment at the PSX had been dampened. Analysts were concerned about a potential global recession and reduced demand in international markets. But the recent developments, including lower commodity prices and a possible competitive edge for Pakistani exports, have opened a window for cautious optimism.

For now, the PSX’s sharp rally is a sign of investor confidence returning — even if only temporarily.

Follow us on Google News, Instagram, YouTube, Facebook,Whats App, and TikTok for latest updates