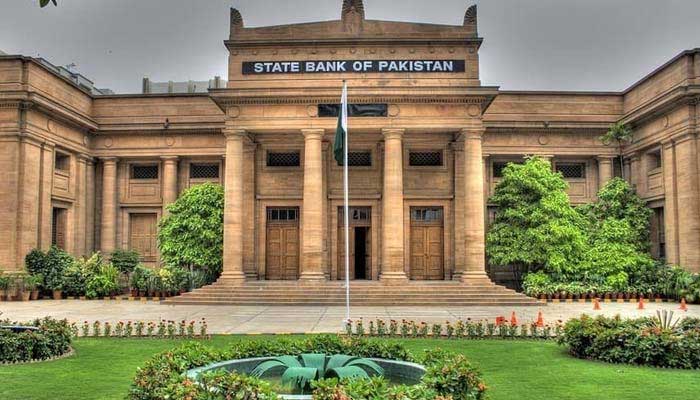

KARACHI: Amid a significant slowdown in inflation, business leaders have urged the State Bank of Pakistan (SBP) to cut policy rate by 300 to 500 basis points. They believe that such a cut is essential to revive trade and industrial activities in the country. The SBP’s Monetary Policy Committee (MPC) is set to meet on Monday to discuss this critical issue.

Disappointment with Current Policy

Atif Ikram Sheikh, President of the Federation of Pakistan Chambers of Commerce and Industry (FPCCI), expressed disappointment with the current monetary policy stance. He noted that it remains based on a heavy premium compared to core inflation. According to government statistics, inflation stood at 6.9% in September, while the policy rate was set at 17.5%. This situation reflects a staggering premium of 1,060 basis points over core inflation.

Sheikh called for an immediate rate cut of 500 basis points. He emphasized that this adjustment aligns with the vision of the Special Investment Facilitation Council (SIFC), which aims to revive economic growth and boost exports.

Future Oil Prices Impact

The context for these demands is favorable, with core inflation recorded at 7.2% in October. Recent reports suggest that international oil prices may decrease, particularly following news that Saudi Arabia might lower crude oil prices for Asia in December. These factors make a compelling case for a substantive policy rate cut, Sheikh noted.

Need for Competitive Edge

FPCCI Senior Vice-President Saquib Fayyaz Magoon also weighed in, proposing that the interest rate should be reduced to 12.5%.

He believes this adjustment would help exporters compete more effectively in regional and international markets. It would significantly lower the cost of capital.

Pressure on Businesses

Muhammad Jawed Bilwani, President of the Karachi Chamber of Commerce and Industry (KCCI), supports the call for a rate cut. He noted that inflation is now under control and commodity prices are stabilizing. A significant reduction of at least 300 to 500 basis points is crucial. This move is vital to relieve financial pressure on businesses. It will stimulate economic activity and revive growth in large-scale manufacturing, which has seen consistent declines in recent months.

Industry Voices and Concerns

Bilwani highlighted the adverse impact of high-interest rates on the manufacturing sector. He stressed that lower rates would provide much-needed relief to businesses grappling with rising costs. Furthermore, he noted that the manufacturing sector’s contraction could lead to job losses and hinder overall economic recovery.

Follow Day News on Google News, Instagram, YouTube, Facebook, Whats App, and TikTok for latest updates