Prize bonds are one of the most popular investment options in Pakistan. They offer an opportunity for people to try their luck in a government-backed lottery system while keeping their investment secure. However, like any financial instrument, prize bonds come with both advantages and disadvantages. Many Pakistanis buy prize bonds in the hopes of winning big prizes, while others see them as a safe way to park their money. But are they truly beneficial in the long run? Let’s explore the pros and cons of prize bonds in Pakistan and what the future holds for those investing in them.

Understanding Prize Bonds

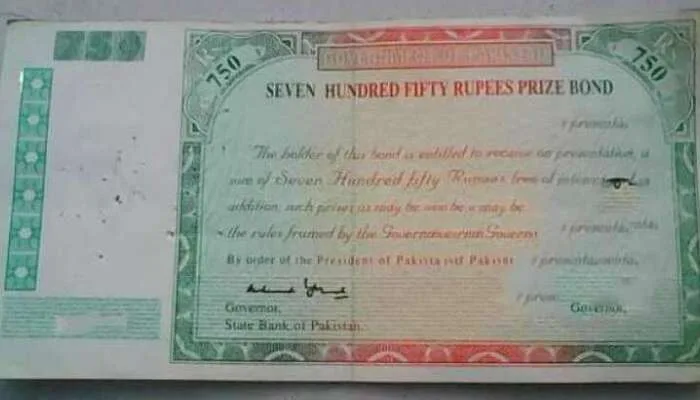

Bonds are issued by the Government of Pakistan through the State Bank and National Savings Centers. They function as a type of lottery, where bondholders enter a draw and have the chance to win cash prizes while keeping their initial investment intact. Unlike other forms of investment, prize bonds do not offer regular interest or dividends; instead, their appeal lies in the possibility of winning a substantial sum.

The prize bond system in Pakistan includes various denominations, ranging from Rs. 100 to Rs. 40,000. The draws are held periodically, and each bond has an equal chance of winning prizes, which can range from a few thousand rupees to millions.

???? What Are the Chances of Winning a Prize Bond in Pakistan?

Prize bonds are a unique savings product in Pakistan, combining investment safety with the thrill of a lucky draw. While many people buy them in hopes of a big win, very few understand the actual chances of winning. So, how likely is it to win a prize? Let’s break it down.

???? Understanding the Odds

Each prize bond draw is based on a large number of issued bonds. The chances of winning depend on the number of winners versus the total number of bonds in circulation. The more common the denomination, the more bonds are issued — which lowers your chances of winning.

Here’s a rough idea of the odds per bond:

???? Rs 100 Prize Bond (example):

-

1st Prize (1 winner): Odds are 1 in 999,999 — extremely rare.

-

2nd Prize (3 winners): Odds are about 3 in 999,999.

-

3rd Prize (1,199 winners): Odds are about 0.12%

???? Is Prize Bond a Good Investment in Pakistan?

Prize bonds are often seen as a “safe bet” by many Pakistanis. They offer a chance to win big prizes while keeping your money secure. But are they actually a good investment? Let’s explore the pros, cons, and the reality behind prize bonds.

???? Is Prize Bond Halal or Haram in Islam?

Prize bonds are a popular financial instrument in Pakistan, but many Muslims question whether they are halal (permissible) or haram (forbidden). Since Islam has clear guidelines on gambling and interest (riba), it’s important to evaluate prize bonds under Islamic principles.

Benefits of Prize Bonds in Pakistan

1. Risk-Free Investment

One of the biggest advantages of prize bonds is that they are a risk-free investment. Unlike stocks or cryptocurrencies, where investors can lose their capital, prize bonds allow individuals to retrieve their original amount at any time without any financial loss.

2. Tax-Free Prize Money

For non-filers, a withholding tax of 30% is deducted on winnings, while for filers, the tax is 15%. However, for those who manage to win big, the remaining prize money is tax-free and can significantly boost financial stability.

3. No Fixed Maturity Period

Unlike fixed deposits or savings accounts, prize bonds do not have a maturity period. Investors can hold onto them indefinitely or sell them at face value whenever needed.

4. Easy Availability and Liquidity

Prize bonds can be purchased and encashed easily from designated banks, the State Bank of Pakistan, or National Savings Centers. Since they do not have a lock-in period, people can convert them into cash whenever they require funds.

5. Encourages a Savings Culture

For many Pakistanis, they serve as an incentive to save money rather than spend it recklessly. Since they do not depreciate and can win prizes, they act as a financial cushion for people who might otherwise struggle to save.

6. Government-Backed Security

Since prize bonds are issued by the government, there is no risk of default or fraud, making them a secure investment compared to private lottery schemes or unregulated investment plans.

Disadvantages of Prize Bonds in Pakistan

1. No Regular Returns or Interest

Unlike savings accounts or fixed deposits, prize bonds do not yield regular returns. Investors can hold them for years without winning a single prize, which means their money does not grow over time.

2. High Competition and Low Winning Probability

While prize bonds offer lucrative rewards, the chances of winning are extremely low. With thousands or even millions of bondholders competing for limited prizes, most people never win anything despite holding bonds for years.

3. Inflation Reduces Value Over Time

Since prize bonds do not offer any interest, the real value of money decreases over time due to inflation. A prize bond purchased today may be worth significantly less in real terms after a decade.

4. Withholding Tax on Winnings

For non-filers, the government deducts 30% of the winnings as tax, while filers are taxed at 15%. This means that even if someone wins, a significant portion of their prize money is taken away.

5. Lack of Productive Economic Contribution

Unlike stocks or mutual funds, which contribute to business growth and the economy, prize bonds do not directly contribute to economic development. The money remains stagnant unless a bondholder wins and spends it.

Read More: Do You Spend Hours Watching Reels or Shorts? Here’s the Hidden Danger

6. Encourages Gambling Mentality

Many people buy bonds with the hope of winning big rather than as a safe investment. This creates a gambling mindset where individuals continuously invest without any guaranteed return, leading to potential financial instability.

What’s in Store for Prize Bond Investors in Pakistan?

The future of prize bonds in Pakistan remains uncertain. The government has already discontinued the Rs. 7,500, Rs. 15,000, and Rs. 25,000 prize bonds to discourage money laundering and undocumented wealth. Many speculate that further restrictions could be imposed, or the entire system might undergo a significant overhaul.

However, prize bonds still hold appeal for many Pakistanis, especially those who prefer secure investments over riskier alternatives. The government might introduce reforms such as linking prize bonds with digital financial services, increasing transparency, or offering some form of interest to make them more attractive.

Alternatives to Prize Bonds

For those seeking better returns, several alternatives exist:

- National Savings Certificates – Offer fixed returns and security.

- Mutual Funds – Provide diversified investment opportunities with professional management.

- Real Estate – A traditional investment that appreciates over time.

- Stocks and Bonds – Offer potential for higher returns with some risk.

Conclusion

Prize bonds in Pakistan remain a double-edged sword. While they offer a risk-free investment with the potential for huge rewards, they lack consistent returns and face high competition. For people looking to save money securely, they are a reasonable option, but they should not be relied upon as a primary investment strategy.

Follow us on Google News, Instagram, YouTube, Facebook,Whats App, and TikTok for latest updates