The Monetary Policy Committee (MPC) decided to maintain the policy rate at 12% in its meeting on March 10, 2025. Inflation in February dropped more than expected due to lower food and energy prices. However, the committee highlighted risks from price volatility, which could reverse the declining trend in inflation. Core inflation remains high, and any increase in food or energy prices may push inflation up. Meanwhile, economic activity continues to strengthen, as shown by high-frequency economic indicators. The committee also noted external pressure due to rising imports and weak financial inflows.

Key Economic Developments

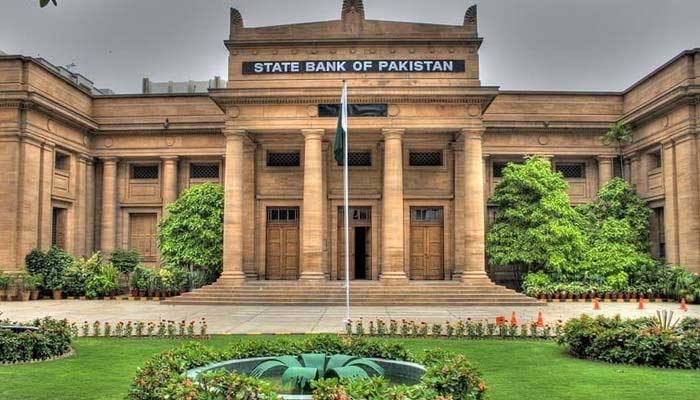

Several economic changes have occurred since the last MPC meeting. The current account posted a deficit of $0.4 billion in January 2025, reversing months of surplus. This, combined with weak financial inflows and debt repayments, reduced the State Bank of Pakistan’s (SBP) foreign exchange reserves. Large-scale manufacturing declined in the first half of FY25, despite a strong monthly rise of 19.1% in December 2024. Tax revenue collection also fell short of the target in January and February. However, business and consumer confidence improved. Globally, rising tariff disputes have increased economic uncertainty, affecting trade and commodity prices. In response, central banks worldwide have slowed monetary easing.

Economic Growth Outlook

The MPC acknowledged that earlier policy rate cuts are starting to show results. The committee emphasized a cautious approach to monetary policy to keep inflation within the 5–7% target range. Structural reforms remain crucial for sustainable economic growth.

Industrial and Agricultural Performance

Economic activity is gaining traction, as seen in sales of automobiles, petroleum products, and cement. Import volumes, private-sector credit, and the purchasing managers’ index also signal improvement. However, large-scale manufacturing declined by 1.9% in the first half of FY25. Some low-weight sectors dragged overall performance, offsetting positive growth in key industries like textiles, pharmaceuticals, and automobiles. In agriculture, recent satellite data suggests that rainfall has reduced risks to Rabi crops. The MPC expects GDP growth of 2.5–3.5% in FY25, with economic momentum strengthening in the second half.

External Sector Pressures

The current account shifted into a deficit in January 2025 due to rising imports, shrinking the cumulative surplus to $0.7 billion for July–January FY25. Increased import volumes and global commodity price hikes contributed to higher import costs. However, steady workers’ remittances and moderate export growth helped finance imports. Financial inflows remained weak due to a shortfall in planned official inflows. Most debt repayments for the year have already been made. With lower repayments and expected official inflows, SBP’s foreign exchange reserves could exceed $13 billion by June 2025. The MPC stressed the need to strengthen external reserves given ongoing global economic uncertainty.

Read: Gold, Silver Prices Remain Stable in Pakistan on Monday, March 10

Fiscal Performance and Revenue Shortfalls

Fiscal accounts for the first half of FY25 showed improvement in overall and primary balances compared to last year. This was due to higher revenues, especially non-tax revenues, and controlled expenditures, mainly subsidies. However, the Federal Board of Revenue (FBR) fell further behind its tax collection targets in January and February. The MPC expects fiscal discipline, along with reduced interest payments, to keep the overall fiscal deficit near its target. However, achieving the primary balance target remains challenging. The committee emphasized the need for fiscal reforms, particularly broadening the tax base, to maintain macroeconomic stability.

Monetary and Credit Trends

Broad money (M2) growth remained steady at 11.4% year-on-year. Government borrowing from banks increased, while private-sector credit declined due to aggressive lending by banks in the second quarter of FY25 to avoid tax penalties. However, private-sector credit growth remains significant at 9.4%, reflecting improved financial conditions and economic recovery. The committee also noted an increase in currency circulation and a slowdown in deposit growth since the last MPC meeting.

Inflation Trends and Risks

Inflation fell to 1.5% year-on-year in February 2025, down from 2.4% in January. Lower food prices, stable exchange rates, and declining global oil prices helped ease inflation. However, core inflation remains high and persistent. Consumer and business inflation expectations are mixed. The MPC expects inflation to decline further before stabilizing within the 5–7% target range. However, risks remain due to food price volatility, energy price adjustments, additional revenue measures, protectionist global policies, and uncertain commodity prices.

The MPC remains focused on maintaining economic stability. While inflation is declining, risks persist. The committee believes that keeping the policy rate at 12% will help sustain macroeconomic stability. It also emphasized the importance of structural reforms, fiscal discipline, and external reserve management to support long-term economic growth.

Follow us on Google News, Instagram, YouTube, Facebook, Whats App, and TikTok for latest updates