The Pakistan Stock Exchange (PSX) crossed the 154,000-point mark on Friday, driven by strong investor optimism despite flood-related risks threatening the economy. The KSE-100 index soared to historic levels as investors bet on improving macroeconomic indicators and a stronger rupee.

Market Breaks New Record

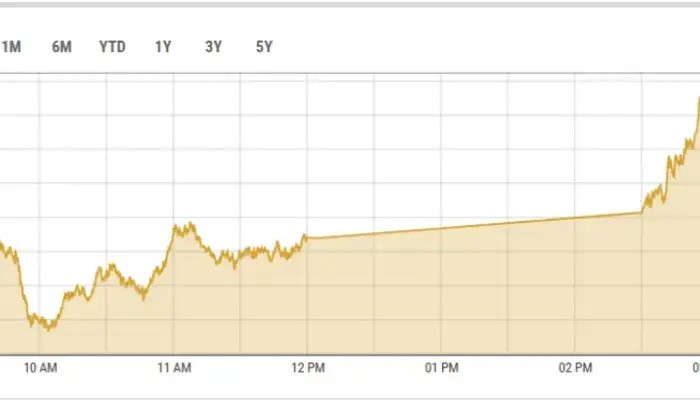

The PSX opened with a sharp rise, gaining more than 1,000 points by mid-morning. By 3:24pm, the KSE-100 index had climbed 1,615 points, reaching 154,280. The rally held firm through the session, and the market closed at 154,277, up 1,611 points, marking a 1.06 percent gain over the previous day.

This performance marked the sixth straight day of gains, solidifying confidence that equities remain the most attractive investment avenue despite natural and economic challenges.

Drivers Behind the Rally

Analysts link the rally to several macroeconomic shifts. Awais Ashraf, research director at AKD Securities, explained that optimism stems from the strengthening rupee and better-than-expected liquidity conditions.

He noted that alternative investment avenues such as real estate, fixed income, commodities, and currency markets are offering limited returns. This gap has driven both institutional and retail investors to the equity market, fueling upward momentum.

Read: Gold Prices Hit Record High Amid Global Economic Turmoil

Impact of Treasury Bill Auction

Friday’s rally also followed the government’s treasury bill auction. The auction raised Rs491 billion, surpassing the Rs400 billion target. The result reflected investor confidence in government securities while leaving more liquidity available for equities.

Yousuf M. Farooq, research director at Chase Securities, pointed out that the equity market now mirrors the optimism phase of the investment cycle. He described the mood as one of “incipient euphoria” in selective sectors, though he cautioned against excessive enthusiasm.

Valuations and Investor Sentiment

While valuations have rebounded compared to two years ago, experts warn they are no longer at deeply undervalued levels. Farooq explained that although valuations are not overstretched, they lack the safety margin seen during earlier lows.

For investors, this means careful planning is necessary. Farooq emphasized that retail participants should avoid speculative short-term strategies. Instead, he advised systematic investment in mutual funds or diversified portfolios to manage risks.

Flood Risks Linger

Despite the market’s strong performance, concerns remain about the impact of ongoing floods. The Pakistan Business Forum has estimated crop losses worth billions of rupees. Such losses threaten both food security and broader economic stability.

Farooq warned that the market’s ability to overlook the flood devastation could be troubling. Ignoring the long-term effects of agricultural and infrastructure damage risks underestimating broader macroeconomic and social challenges.

Resilience in the Face of Crisis

Yet the market continues to display resilience. The rally shows that investor confidence in Pakistan’s long-term growth potential remains intact. Equities are still seen as a vehicle for wealth creation, provided investors focus on fundamentals rather than speculation.

Experts note that Pakistan’s equity market has historically rewarded disciplined, long-term investors. However, they stress that such gains require patience and a realistic appreciation of risks.

The Role of the Rupee

A significant factor driving the latest rally is the rupee’s recent strengthening against major currencies. Stability in the exchange rate boosts confidence, reduces import pressures, and reassures foreign investors. For domestic investors, a stronger rupee lowers inflation expectations, creating room for more spending and investment.

Sectors Benefiting from Momentum

While the rally lifted the overall market, certain sectors attracted higher attention. Banking, energy, and cement stocks saw increased activity, reflecting investor bets on economic recovery and infrastructure demand. Export-oriented sectors also benefited from expectations of stable exchange rates and stronger regional trade prospects.

However, experts caution that selective overvaluation may already be appearing in hot sectors. Investors are urged to balance portfolios and not concentrate too heavily in a few industries.

Long-Term Outlook

The long-term outlook for PSX remains positive, but it is closely tied to Pakistan’s ability to manage ongoing crises. Flood recovery, inflation control, and structural reforms will shape future momentum.

If macroeconomic reforms continue and climate shocks are managed more effectively, the equity market could sustain its role as a primary driver of wealth creation. But without addressing vulnerabilities, optimism may give way to volatility.

Cautious Optimism Ahead

The PSX rally to 154,000 points highlights both opportunity and risk. On one hand, equities remain attractive compared to other asset classes, buoyed by a stronger rupee and investor confidence. On the other, flood damage and macroeconomic uncertainty loom large.

For retail investors, the message is clear: adopt disciplined strategies, diversify holdings, and invest with patience. The long-term potential of Pakistan’s equity market remains promising, but it demands prudence as much as optimism.

Follow us on Instagram, YouTube, Facebook,, X and TikTok for latest updates