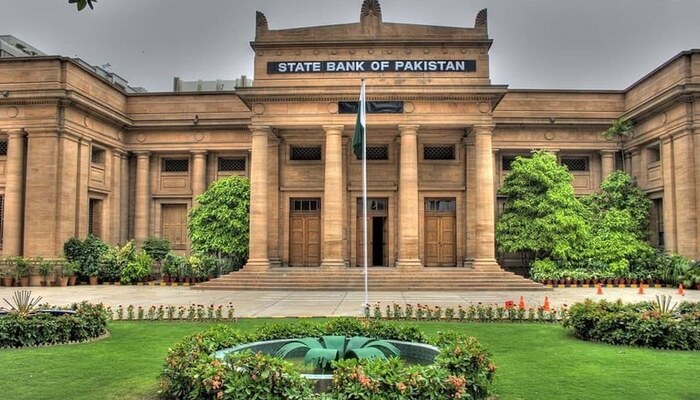

The State Bank of Pakistan has issued a strong directive aimed at strengthening SBP consumer protection standards. It has ordered commercial banks and financial institutions (FIs) to compensate customers for financial losses within two business days in case of a data breach. The central bank’s move highlights growing concern about digital banking risks and the need for swift remedies when customer trust is at stake.

Compensation for Losses

Under the new directive, banks and FIs must act immediately if customer data is compromised. They must take urgent steps to block digital channels, raise dispute requests, or implement other protective measures. If they fail to act promptly and customers suffer losses, banks will be fully responsible. In such cases, customers must be compensated in full within two working days.

The SBP stressed that institutions cannot shift the burden of their negligence onto customers. Delays in remedial actions will not be tolerated. By enforcing this rule, the regulator aims to make the banking system more accountable and responsive.

Timely Communication With Customers

In addition to financial compensation, banks are required to inform customers within 48 hours of a breach. The notification must clearly explain what measures are being taken to prevent further harm. Quick communication, the SBP noted, is crucial for building trust and helping customers take additional precautions.

This step ensures that customers are not left in the dark when their sensitive data is at risk. Transparency and timely updates will be mandatory across all financial institutions.

Transactional Insurance Option

The central bank has also directed banks to provide transactional insurance at competitive rates. However, this insurance will only apply if customers give explicit consent. By making it optional, the SBP ensures that customers are not forced into paying extra charges but still have the choice to enhance their financial security.

The availability of affordable insurance is expected to give customers an added layer of protection against cyber fraud and other financial crimes.

Draft Framework for Fair Treatment

To back these directives, the SBP has introduced a draft regulatory framework called “Business Conduct and Fair Treatment of Consumers Regulatory Framework (BC&FRF).” This initiative is part of a broader effort to improve fairness and responsibility in Pakistan’s financial sector.

The framework lays down principles for fair treatment, transparency, and respect in all interactions between banks and customers. It highlights accountability at every level, ensuring that both senior management and staff are held responsible for lapses.

Read: KSE-100 Index Hits Record High as Market Rally Extends

Strengthening Fraud Detection

The draft framework also requires financial institutions to improve their internal monitoring systems. Fraud and breaches must be detected quickly and reported to the SBP without delay. Employees who fail to report such incidents promptly will be held accountable.

By holding staff responsible, the SBP aims to remove loopholes that allow fraud cases to go unnoticed or unreported. Stronger reporting mechanisms will ensure that both customers and the regulator receive accurate information in real time.

Free Transaction Alerts

Another major change concerns customer notifications. The SBP has mandated that all banks send free transaction alerts. These alerts will apply to all financial activities carried out through ATMs, point-of-sale systems, RTGS, internet banking, and other digital channels.

In addition, free alerts must also cover:

Logins from new devices.

Password resets.

Failed login attempts.

Requests for new lending products.

The central bank directed banks to prioritize these alerts and ensure that sufficient bandwidth is available for instant delivery. This step will help customers detect suspicious activity quickly and reduce fraud risks.

Enhanced Security Features

The draft framework also sets out several new security requirements. Banks must allow customers to activate or block their cards for online and cross-border transactions. Confidential data must be erased from memory after app uninstallation, logoff, or unexpected shutdowns.

Credential resets, such as password changes, will only be allowed from registered devices. To enhance customer verification, banks must use modern methods such as OTP auto-fetch with sender binding. Where this is not possible, alternatives like Robo Call Back, Call Back Confirmation, or NADRA-based biometric checks should be used.

By tightening these security protocols, the SBP aims to reduce loopholes that hackers could exploit.

Rules for Passwords and Sessions

The framework further instructs financial institutions to define and enforce strict rules for managing passwords, PINs, and account security. This includes session timeouts, account locking and unlocking policies, and minimum password standards.

Such rules are expected to make it harder for unauthorized users to gain access to customer accounts. They will also ensure that banks maintain uniform practices across all digital platforms.

Open for Public Feedback

The SBP has invited feedback from the public on the draft framework. Suggestions will be accepted until September 30, 2025. This consultation period allows stakeholders, including customers, industry experts, and advocacy groups, to share their input before the framework becomes final.

By opening the process to the public, the SBP is signaling its commitment to transparency and inclusiveness in shaping consumer protection policies.

A Step Toward Safer Banking

These directives mark a major step in building trust in Pakistan’s financial system. By making compensation mandatory, ensuring free alerts, and tightening digital security, the SBP is placing customer protection at the center of financial regulation.

The combination of immediate accountability, stronger monitoring, and new technology-driven safeguards reflects a clear shift toward safer, more customer-focused banking in Pakistan.

Follow us on Instagram, YouTube, Facebook,, X and TikTok for latest updates